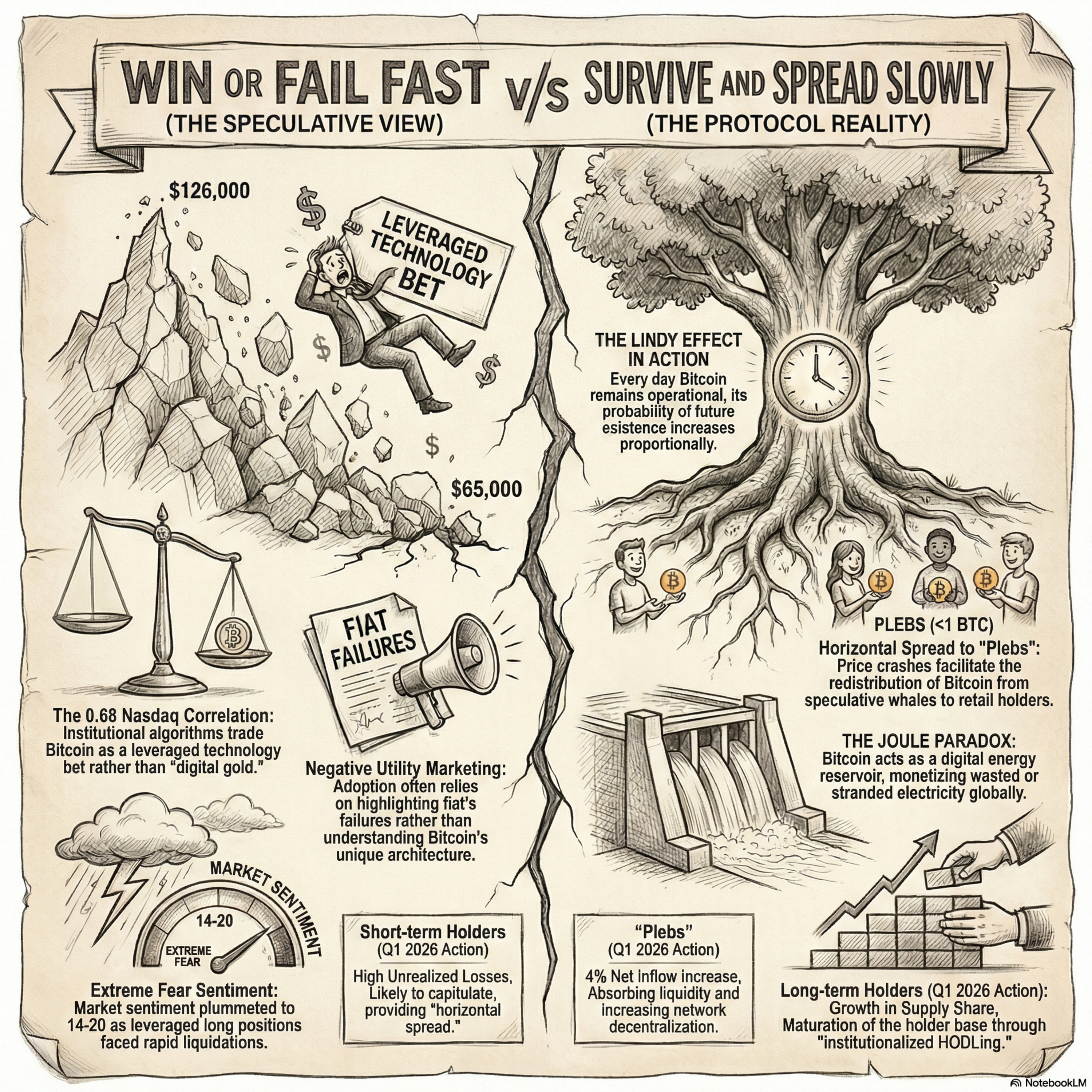

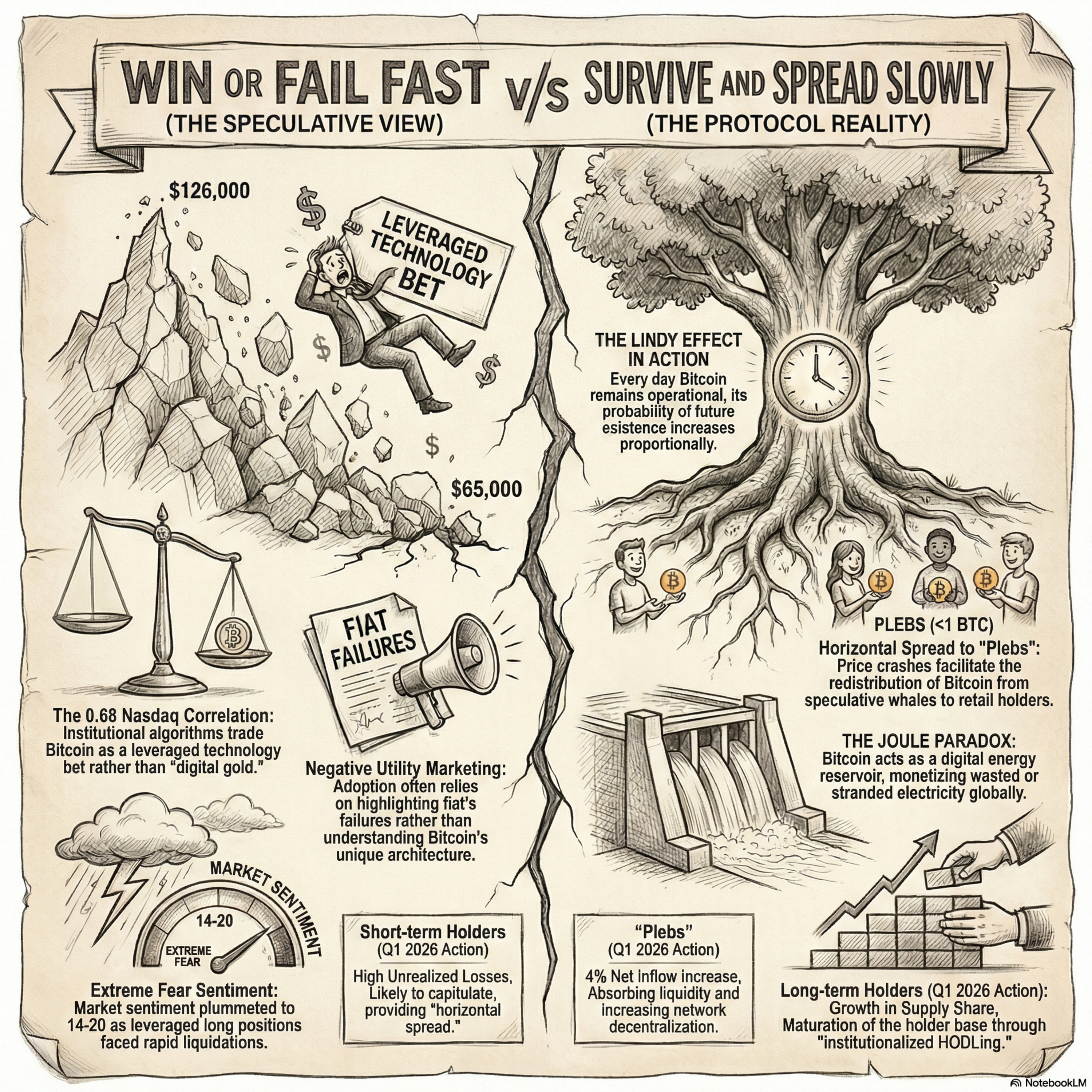

Source Research This episode explores the resilient nature of Bitcoin during a fictional 2026 market downturn, framing its continued existence as an educational and thermodynamic victory rather than a mere financial one. The author argues that Bitcoin’s primary value lies in its antifragility, where surviving significant price crashes and geopolitical instability serves to validate the protocol’s security and teach the public about mathematical scarcity. Beyond its role as a speculative asset, the source redefines Bitcoin as a global energy reservoir that monetizes wasted electricity through a unique relationship between power and value known as the Joule Paradox. Ultimately, the document suggests that market volatility facilitates a horizontal redistribution of wealth from short-term speculators to long-term "believers," solidifying the network's status as a permanent, sovereign ledger for the modern world.#SurvivalAsSuccess – Reflecting the argument that Bitcoin’s objective is not a rapid victory over legacy finance, but a "sustained survival" that functions as an educational mechanism.#LindyEffect – Based on the principle that Bitcoin’s life expectancy increases with every day it survives without compromise; its "reverse-aging" process legitimizes it as a fixture of the modern world,.#Antifragility – Highlighted as the protocol's ability to evolve through stress, where every crash and hard fork adds to its cumulative robustness.#TrustInCode – Representing the shift from "trust in institutions" to "trust in code," a necessary step for a decentralized society.#JouleParadox – Derived from the specific concept mentioned in the text: "energy sets the value of bitcoin and bitcoin sets the value of energy".#DigitalEnergyReservoir – Reframing the protocol as a mechanism for storing and transmitting energy-derived value rather than just consuming electricity.#ThermodynamicMoney – Referring to Bitcoin’s role as a "thermodynamic educational protocol" that converts physical energy into informational order,.#EnergyArbitrage – Describing mining as a system that sets a global floor price for electricity and monetizes wasted or stranded energy sources,.#TheWarshEffect – Referencing the volatility introduced by the nomination of Kevin Warsh as Federal Reserve Chair, whose cautious stance on rate cuts spooked markets in early 2026.#LiberationDayTariffs – Citing the specific geopolitical event (Trump's tariff announcement) that triggered the flight from risk assets on February 1, 2026,.#IdentityCrisis – Highlighting Bitcoin's current struggle between being a "tech stock" (with 0.88 volatility correlation to equities) and "digital gold".#MarketCorrection2026 – Contextualizing the crash to $65,000 as a "liquidity wave" rather than a systemic failure,.#GlobalBounty – Describing Bitcoin’s security model as a public, open-entry test where the billions stored in the network act as a bounty for anyone who can break the encryption,.#GenesisCoins – Referring to the unmoved coins from the Satoshi era as "empirical proof" that the mathematics behind the protocol remains unbreakable.#QuantumResistant – Acknowledging the existential threat posed by quantum computing advancements (like Google's research) and the community's push toward new signature schemes.#SovereignLedger – Emphasizing the database's role in providing transparency and security without central authority,.#HorizontalSpread – A key concept in the sources describing the redistribution of assets from whales to a broader base of retail users ("plebs") during price crashes,.#PlebAccumulation – Highlighting the data showing that small wallets (<1 BTC) increased inflows while whales sold during the early 2026 dip,.#DeepDormancy – Referring to the "HODL wave" metrics showing a growing share of supply migrating into the 7-10 year age band, forming the bedrock of network legitimacy.

See moreTop comments