Hard Money vs Fiat battle : 401 K assessment - beyond tribalism and rabbit hole rants !

EpisodeFeb 137m

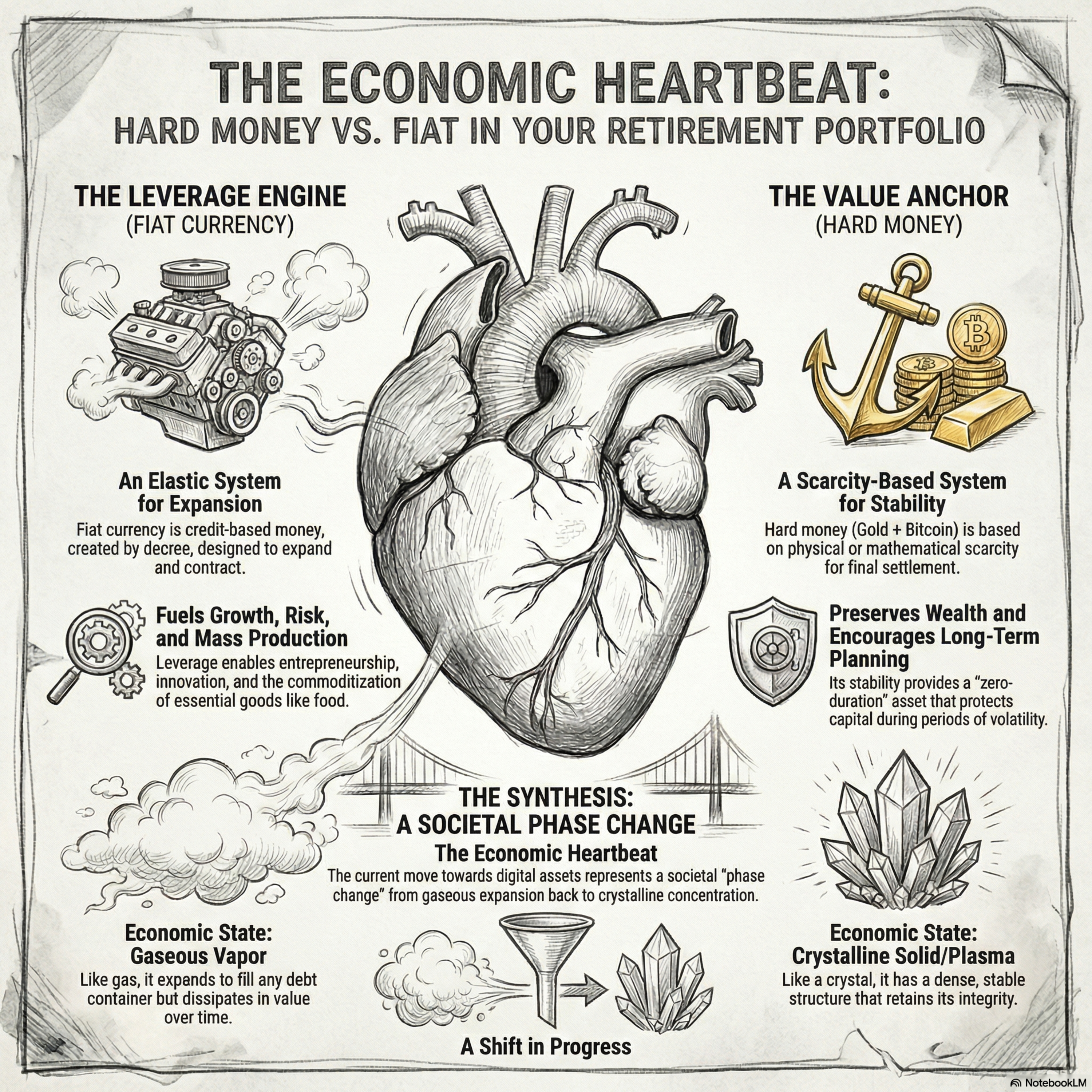

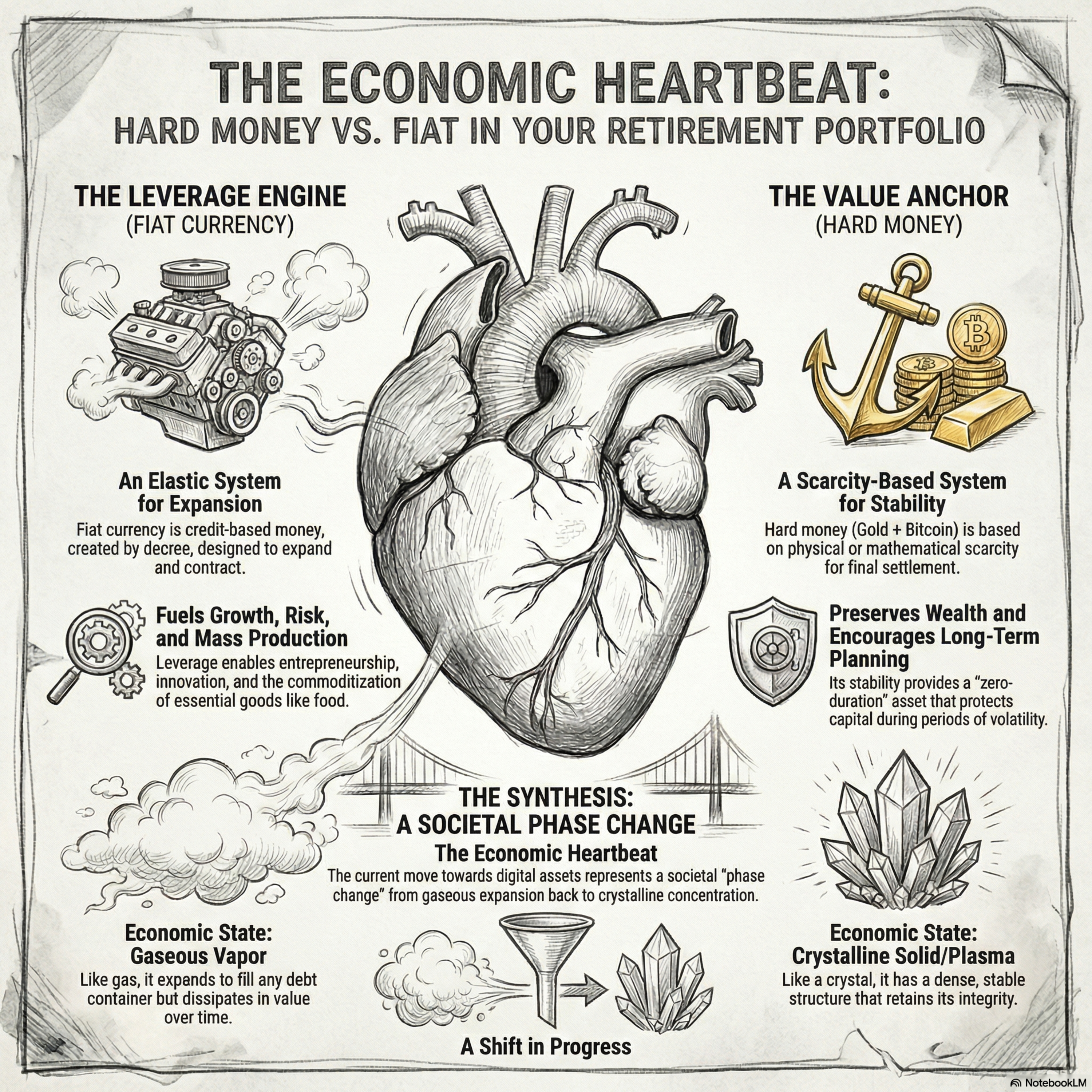

Source Text ChartsBitcoin course #Gold #bitcoin #fiatThis episode explores the dual nature of the global economy through a framework of Value and Leverage, portraying them as the rhythmic heartbeat of human civilization. The author defines Value as a centripetal force of stability and terminal settlement anchored by the scarcity of gold and Bitcoin, while Leverage acts as an expansionary engine that drives innovation, risk-taking, and mass production through elastic credit. By applying thermodynamic metaphors, the source describes the historical transition from the "solid" integrity of gold to the "gaseous" dilution of fiat currency, eventually culminating in a phase change toward the "plasma-like" efficiency of digital scarcity. Ultimately, the work suggests that society is currently pivoting back toward a Value-based paradigm, where the concentration of capital in the hands of industrious allocators and the "crystalline" order of mathematical scarcity provide a necessary counterbalance to previous eras of inflationary expansion. #ValueVsLeverage – Referring to the two distinct structures governing the modern global economic landscape.#TheEconomicHeartbeat – Describing the competition between Value and Leverage as the essential rhythm of a functioning civilization.#NewWorldOrder – From the title of the deep dive, indicating the shifting global economic framework.#GoldPlusBitcoin – Representing the "Equation of Value" which synthesizes physical and digital scarcity into a unified anchor.#TerminalSettlement – Highlighting the role of Value assets in facilitating final asset transfers rather than IOUs.#AbsoluteScarcity – Referring to Bitcoin’s mathematical limit of 21 million units and Gold’s high stock-to-flow ratio.#ZeroDuration – Describing assets like Gold that carry no counterparty risk.#LowTimePreference – The societal incentive to plan intergenerationally in a Value-based system.#FiatTimesDebt – Representing the "Equation of Leverage" where currency derives value from decree and functions as a multiplier.#EconomicExpansion – Acknowledging leverage as the "breath" of the economic universe necessary for risk-taking and innovation.#NixonShock – The 1971 event that unhinged the dollar from gold, acting as a catalyst for global commoditization.#Commoditization – The mass production enabled by leverage and automation.#CantillonEffect – The mechanism of "functional bifurcation" where early receivers of new money benefit before prices rise.#IndustriousAllocators – The class of high-performing individuals (like Elon Musk) who concentrate capital to drive global growth,.#FunctionalBifurcation – The splitting of society into economic tiers to direct resources toward "higher-order" missions,.#MonetaryThermodynamics – The analogy comparing Gold to solids, Fiat to gas/vapor, and Bitcoin to plasma.#SocietalPhaseChange – The concept that a change in the store of value mirrors a change in societal orientation.#DigitalCredit – Emerging as "Anti-Leverage" in the Bitcoin paradigm, acting as a centripetal force rather than a centrifugal one.#Crystallization – The shift from the "gaseous expansion" of fiat back to the ordered density of a scarcity-based system.

See moreTop comments