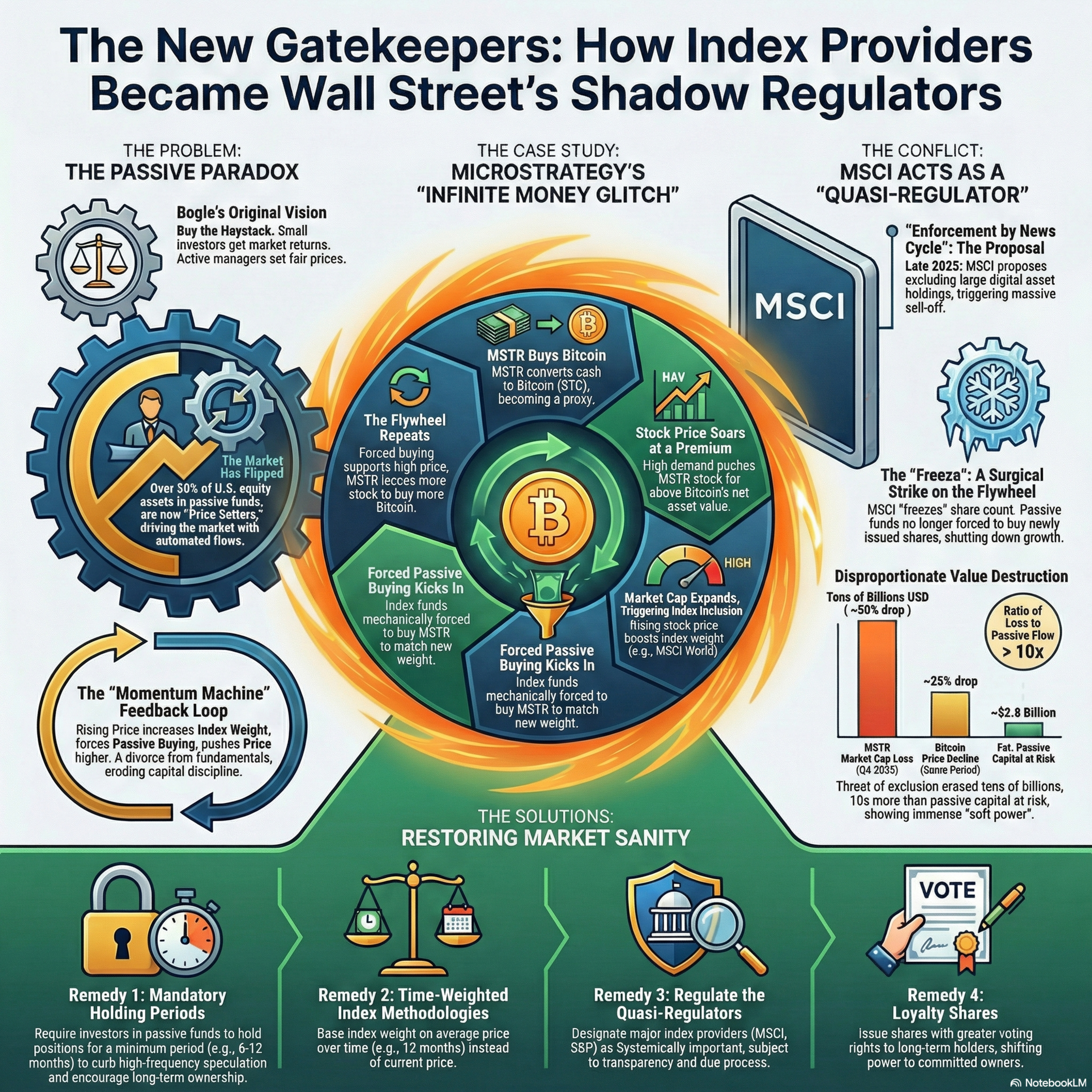

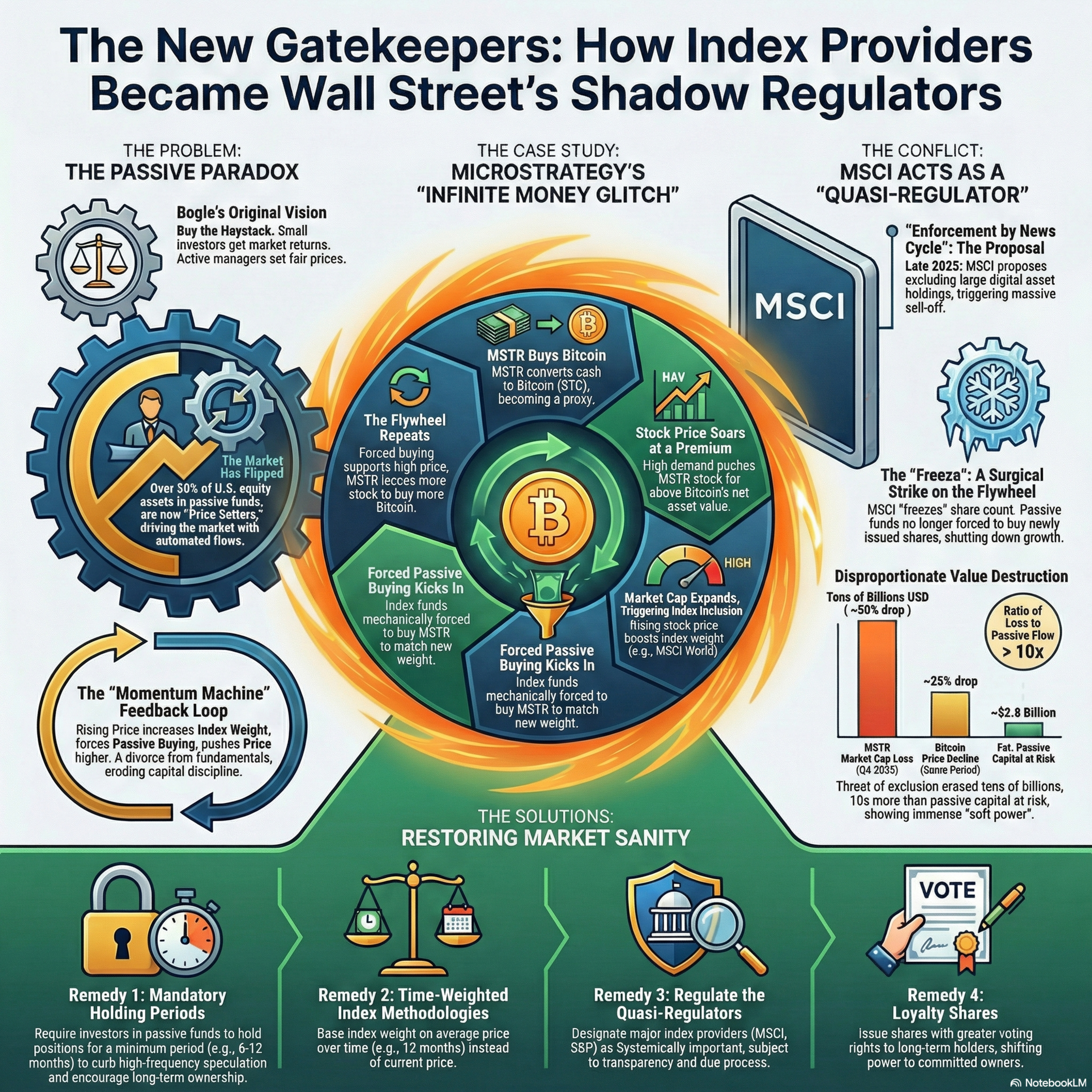

Research STRC Audio Course MosaicThis episode examines the structural fragility of modern financial markets caused by the transition from Jack Bogle’s passive investing ideal to a system where mechanical index flows dictate stock prices. The author critiques index providers like MSCI, labeling them "quasi-regulators" who exercise immense, unaccountable power by "spooking" markets and effectively "de-banking" equity capital through opaque exclusion threats. #PassiveInvesting: This strategy, which focuses on broad market exposure rather than individual stock picking, is the central theme of the report.#JackBogle: As the founder of Vanguard and the architect of the "haystack" philosophy, Bogle's theories are essential for understanding the roots of current market structures.#TheHaystack: This refers to Bogle’s famous advice to stop looking for the "needle" (winning stocks) and instead buy the entire market (the "haystack").#CapitalAllocation: The sources argue that the mechanical flows of passive capital have decoupled from fundamental value, leading to a crisis in how capital is allocated globally.#MarketCapWeighted: This hashtag highlights the current indexing methodology where price increases lead to forced buying by passive funds, creating "momentum machines".#MicroStrategy or #MSTR: The company serves as the primary case study for how a firm can weaponize index inclusion.#MichaelSaylor: Saylor’s leadership in adopting the "Bitcoin Standard" transformed MSTR into a high-beta proxy for the digital asset.#BitcoinTreasury: This describes the strategy of converting cash reserves into Bitcoin, which the sources define as a "flywheel" that exploits passive indexing.#DATCO: This refers to the "Digital Asset Treasury Company" classification proposed by MSCI to regulate companies whose digital holdings exceed 50% of their assets.#AccretiveDilution: This technical term explains how MSTR issues equity at a premium to buy Bitcoin, increasing per-share value for existing holders.#MSCI: As a major index provider, MSCI’s actions—such as the share count "freeze"—are analyzed as a form of private regulation.#QuasiRegulators: The sources define index providers like MSCI and S&P Global as "quasi-regulators" because they wield the power to destroy shareholder value through opaque decision-making.#EnforcementByNewsCycle: This phrase describes how the mere proposal of index exclusion can trigger catastrophic market repricing before any rule is finalized.#OperationChokepoint: Referencing Mark Andreessen’s critiques, this hashtag relates to the use of regulatory pressure to "de-bank" or "de-index" disfavored industries.#MarkAndreessen: His theories on how regulators "spook" the market and stifle innovation are central to the critique of index providers.#TimeWeightedIndex: A proposed alternative to capitalization-weighting that uses average prices over time to dampen speculative spikes.#MandatoryHoldingPeriods: A suggested regulatory remedy to turn "renters" of stock back into long-term "owners".#LoyaltyShares: This refers to the proposal for "L-shares" that grant increased voting rights to long-term shareholders.#FinancialEngineering: This captures the critique of MSTR’s strategy, which the MSCI index committee viewed with more hostility than Tesla’s "productive speculation".

Top comments