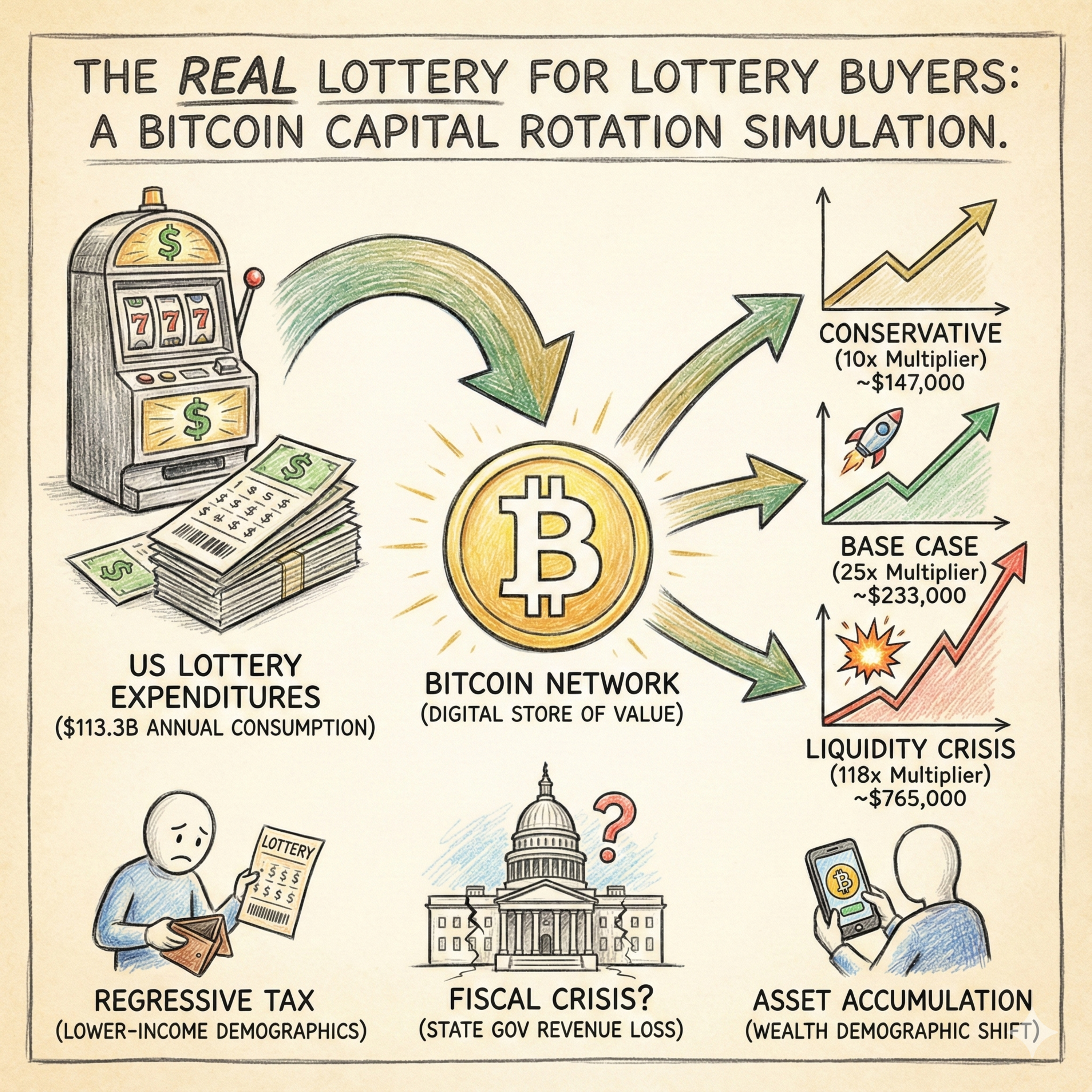

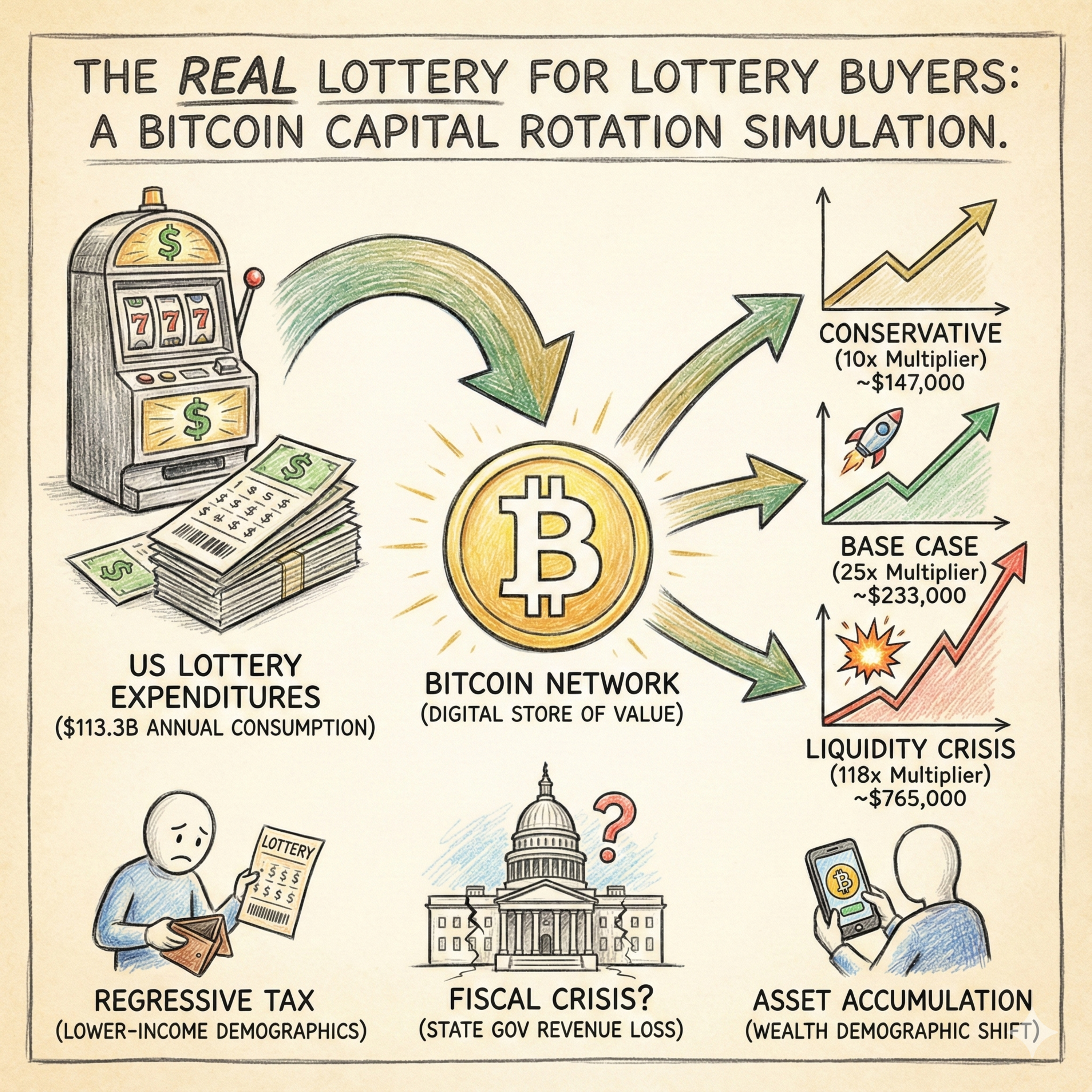

ResearchReferences in this episode: mosaic.soA comprehensive economic simulation models a hypothetical Great Capital Rotation: the redirection of the aggregate $113.3 billion in annual United States lottery expenditure into the Bitcoin network. This systemic reallocation converts a consumption habit, which acts as a regressive tax, into a high-velocity digital store of value.This shift would constitute one of the largest retail-driven capital inflows in financial history, fundamentally altering market structure and wealth demographics "Just in USA."The inflow translates to an approximately $310 million buying pressure hitting the market every single day, relentlessly and regardless of price. This persistence is the engine of the shock. Critically, this daily flow is 7.6 times larger than the daily issuance of new Bitcoin mined post-2024 halving. Since Bitcoin's supply is algorithmically fixed and highly illiquid (28% to 70% of supply is held by Long-Term Holders), the market cannot absorb this pressure linearly.The $310 million daily inflow exceeds the entire global 1% market depth (typically $100 million to $300 million), meaning the market is structurally incapable of absorbing the demand without violent upward price repricing. This mismatch triggers the "Crypto Multiplier" effect, where every dollar entered results in massive market capitalization growth.Using established multiplier frameworks, the simulation provides profound price projections within the first year:Conservative Scenario (10x Multiplier): Price appreciates to approximately $147,000 per BTC.Base Case Scenario (25x Multiplier): Price, reflecting real-world supply shock dynamics, reaches $233,000 per BTC.Aggressive Scenario (118x Multiplier): Modeling an extreme illiquidity event, prices are driven toward $765,000 per BTC, rapidly challenging the market capitalization of Gold.The resulting socioeconomic transformation is historic. The rotation converts the lottery—a wealth destruction engine that results in an aggregate loss of roughly $43 billion annually for players—into an asset accumulation vehicle. In the Base Case, the $113 billion invested would grow to nearly $300 billion in value, creating a massive Wealth Effect concentrated in lower and middle-income demographics. Furthermore, the psychology of lottery players—who treat the purchase as a binary bet (millions or zero)—translates into exceptionally sticky, price-insensitive "Diamond Hand" holding, further fueling the high-multiplier scenarios.However, the "Just in USA" shock carries an immediate public sector cost. State governments face an immediate fiscal crisis, as they rely on $30 billion to $35 billion in net lottery proceeds annually to fund essential services (e.g., education, senior programs). The disappearance of this immediate, predictable revenue stream forces states to contemplate raising politically toxic taxes (such as sales or property taxes) to fill the hole, creating a crippling liquidity gap while citizens hold appreciated, but untaxed, assets.The localized nature of the flow, originating from US banking rails, would cause a "Coinbase Premium," where the US spot price trades measurably higher than global averages. This triggers massive global arbitrage, ultimately resulting in a strategic accumulation of the world’s liquid Bitcoin supply into US custody, centralized in the wallets of the working class. This simulation reveals the rapid demonetization of the state lottery extraction engine and the simultaneous remonetization of Bitcoin at an unprecedented scale.#Bitcoin #BTC #Crypto #CapitalRotation #SupplyShock #Lottery #FiscalCrisis #WealthTransfer #CoinbasePremium #EconomicSimulation #HODL #USD #Finance

Top comments