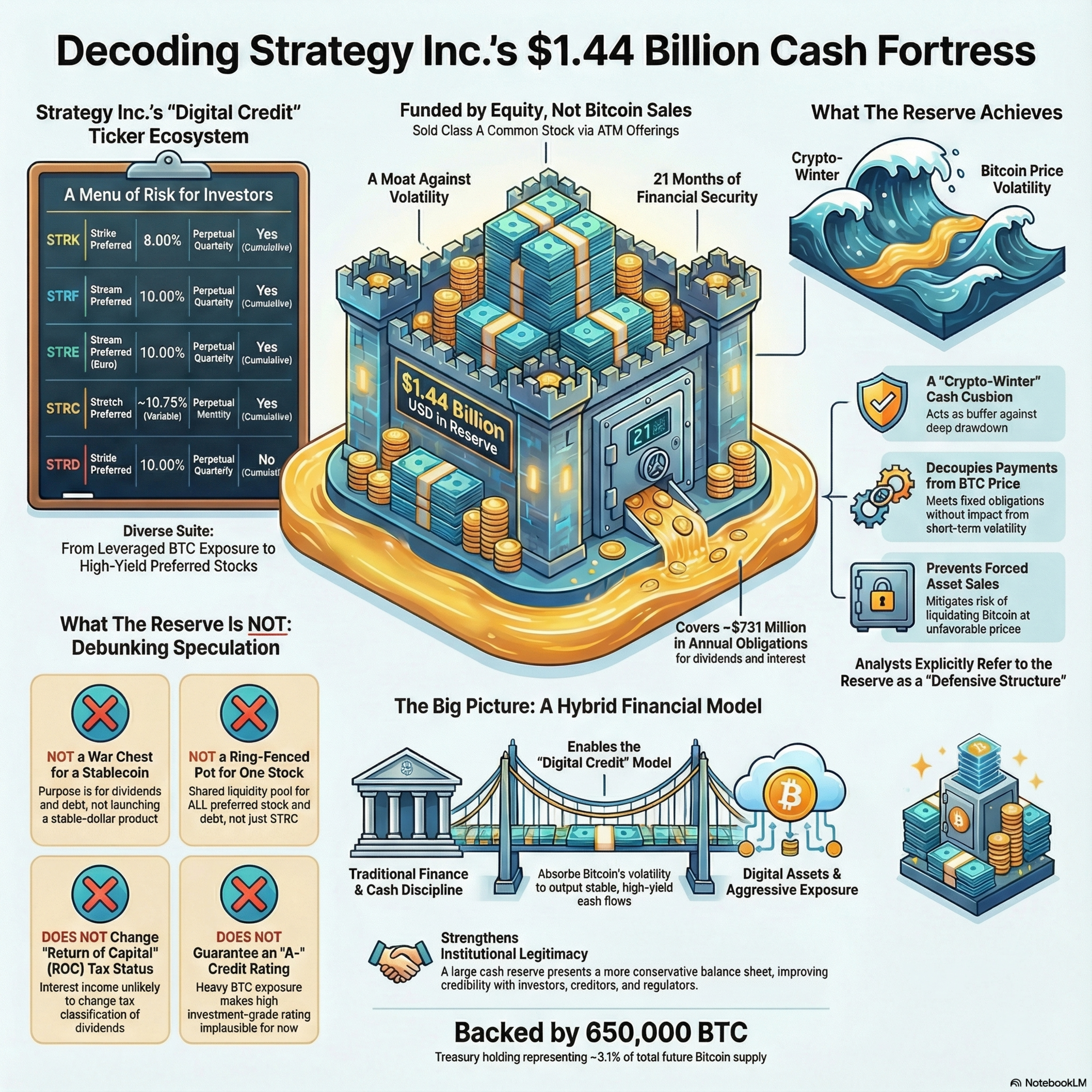

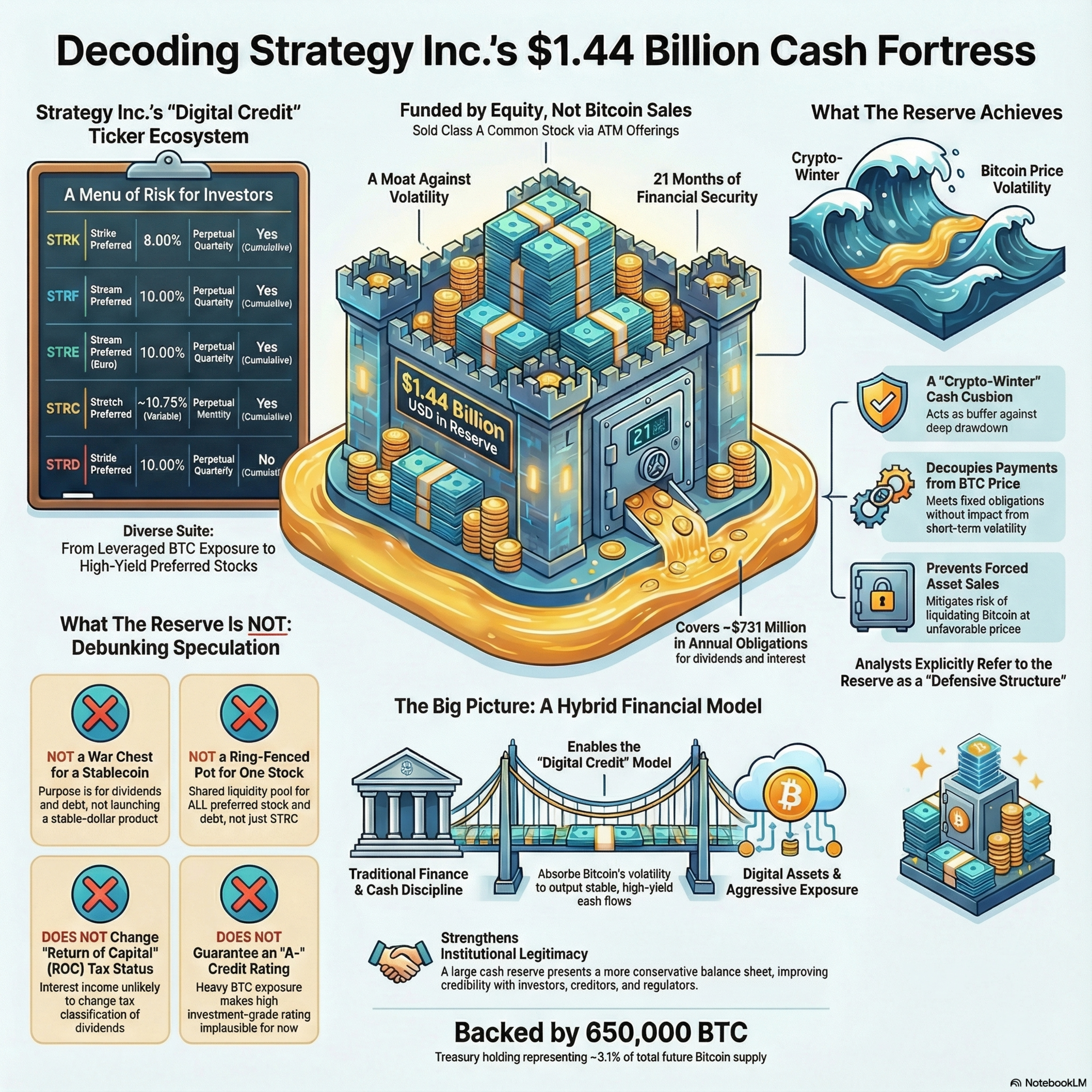

Previous Episode on topicMosaicStrategy Inc., the world's leading Bitcoin Treasury Company, has fundamentally changed its risk profile by establishing a substantial U.S. dollar reserve. This cash fortress, totaling $1.44 billion, was created through the sale of common stock, leveraging the market’s high valuation of the company's platform. The reserve's explicit mandate is to cover fixed obligations, including debt interest and all preferred stock dividends, providing a crucial cash cushion for nearly two years.This move is designed to insulate the company's "Digital Credit" model from Bitcoin’s inherent volatility, ensuring that Strategy Inc will not be forced to sell its vast Bitcoin holdings—650,000 BTC—to meet short-term financial duties during a market crash or "crypto winter." By pre-funding its liabilities, the company secures its core strategy of relentless Bitcoin accumulation.The preferred stocks, such as STRC, are engineered for price stability and high yield. While these securities are legally unsecured, they are robustly protected because they sit high in the capital structure. Expert analysis confirms that even in a catastrophic collapse of the underlying asset value, the company's remaining assets would be sufficient to protect the preferred shareholders' principal. The common stock holders are the residual claimants who absorb the first and largest losses, effectively making the common stock a leveraged bet on Bitcoin's appreciation.A key benefit for preferred shareholders is that dividends are generally treated as a tax-deferred Return of Capital. This results from the company’s adherence to its "never sell Bitcoin" strategy, which avoids realizing taxable gains and keeps the company's taxable income negative.The reserve enhances the company's standing with creditors and regulators, positioning Strategy Inc as a hybrid entity that balances aggressive digital asset exposure with conservative liquidity discipline. This model buys time for the company's long-term thesis to play out without the existential threat of short-term insolvency.#DigitalCredit #BitcoinTreasury #CryptoFinance #StrategyInc #STRC #PreferredStock #CorporateFinance #SaylorStrategy #Liquidity #FinancialEngineering

Top comments