STRC : The killer app of #bitcoin network - and it is NOT on #blockchain

EpisodeJan 228m

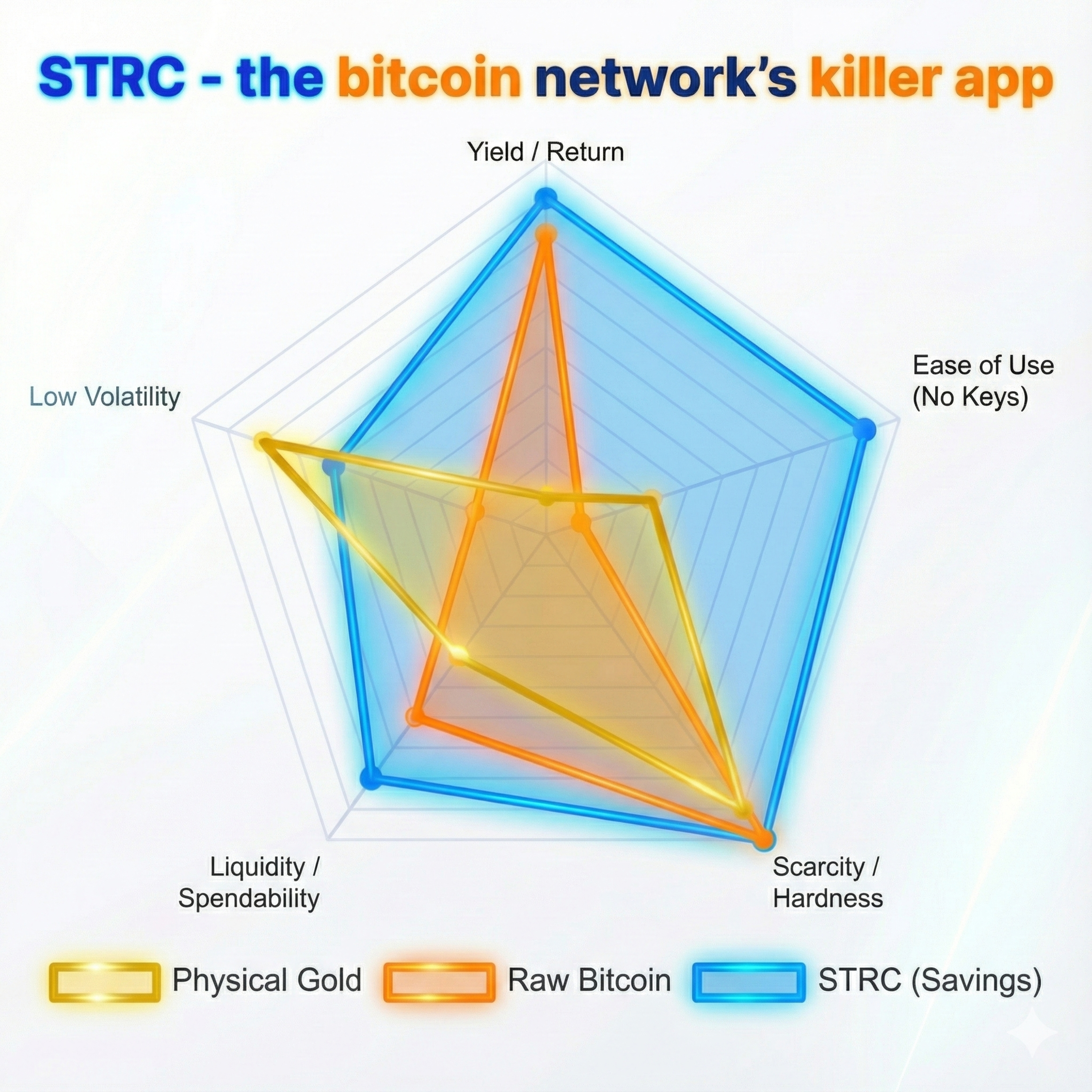

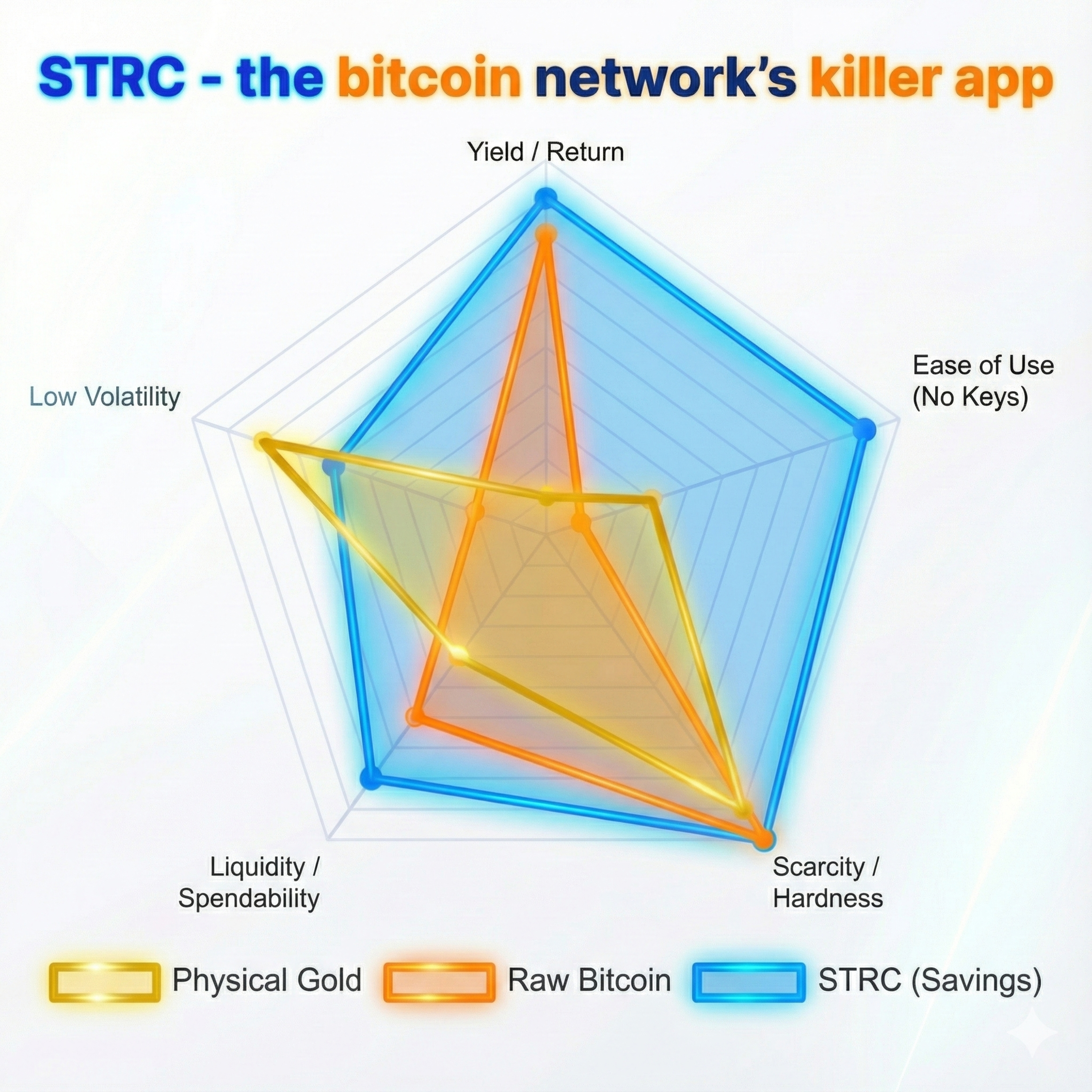

ResearchMosaicSTRC CourseThis episode explores Bitcoin’s transition from a volatile crypto asset to a sophisticated global savings vehicle through the emergence of digital credit. By utilizing an application layer that abstracts away the technical hurdles of self-custody, financial products like Strategy Inc.’s STRC allow everyday investors to access Bitcoin-backed yields via traditional brokerage accounts. This "iPhone moment" for the network targets the USD 11 trillion corporate bond market, offering a high-yield, tax-advantaged alternative to traditional debt instruments. Ultimately, the text argues that Bitcoin’s true utility lies in its role as pristine collateral, providing a stable and productive engine for wealth preservation on a global scale.The "Killer App" & Digital Credit• #DigitalCredit: Bitcoin has evolved from a payment rail into the ultimate collateral for a new era of credit.• #GlobalSavingsAccount: The true "killer app" for Bitcoin is a high-yield savings vehicle accessible to everyone.• #KillerApp: By transforming volatile capital into a productive asset, the long-awaited primary use case for Bitcoin has arrived.• #BitcoinSavings: This model moves Bitcoin beyond gold-like storage into an active, yield-generating savings account.STRC & The "iPhone Moment"• #IPhoneMoment: The STRC instrument acts as an interface layer that abstracts the technical complexity of private keys and blockchain interaction.• #STRC: The flagship product from Strategy Inc. that packages Bitcoin as a familiar preferred stock.• #AbstractedComplexity: Investors can now utilize the Bitcoin network through standard brokerage accounts without technical friction.• #NoPrivateKeysRequired: Digital Credit eliminates the custody crisis by using regulatory rails and familiar financial structures.Yield & Tax Advantages• #HighYieldSavings: The new model offers a high annual dividend rate that significantly outperforms traditional banking products.• #TaxAdvantagedYield: Because distributions are classified as a Return of Capital, the yield is largely tax-deferred.• #ReturnOfCapital: This unique structure allows investors to grow wealth more efficiently than fully taxable corporate bonds.• #MonthlyDividends: Payouts are designed to match the monthly liability cycles of households and pension funds.Market Disruption & Security• #BondMarketDisruptor: Strategy Inc. is targeting the massive ocean of capital currently parked in the traditional corporate bond market.• #DigitalCapital: Bitcoin is recognized as adult, pristine capital that works to generate yield rather than sitting idle.• #WarChest: A massive cash reserve decouples dividend reliability from asset volatility, ensuring stability during market downturns.• #StrategyInc: The pioneer of the corporate treasury yield curve and the architect of the Bitcoin-backed savings revolution.Sovereign & Macro Impact• #WealthMigration: A gargantuan change is underway as global savings seek a life raft against inflation.• #InstitutionalBitcoin: Digital credit products provide the necessary bridge for large-scale institutional and sovereign capital.

Top comments