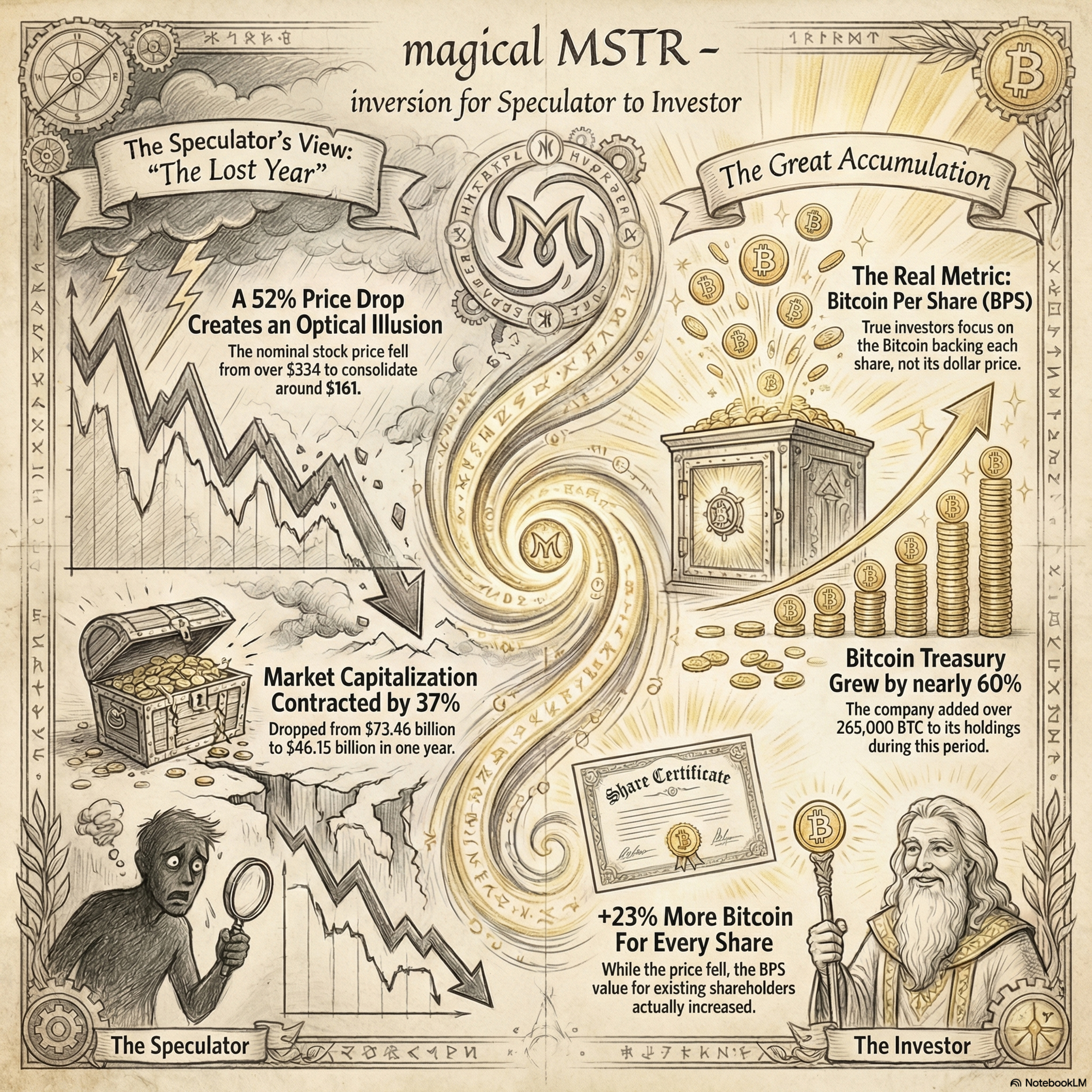

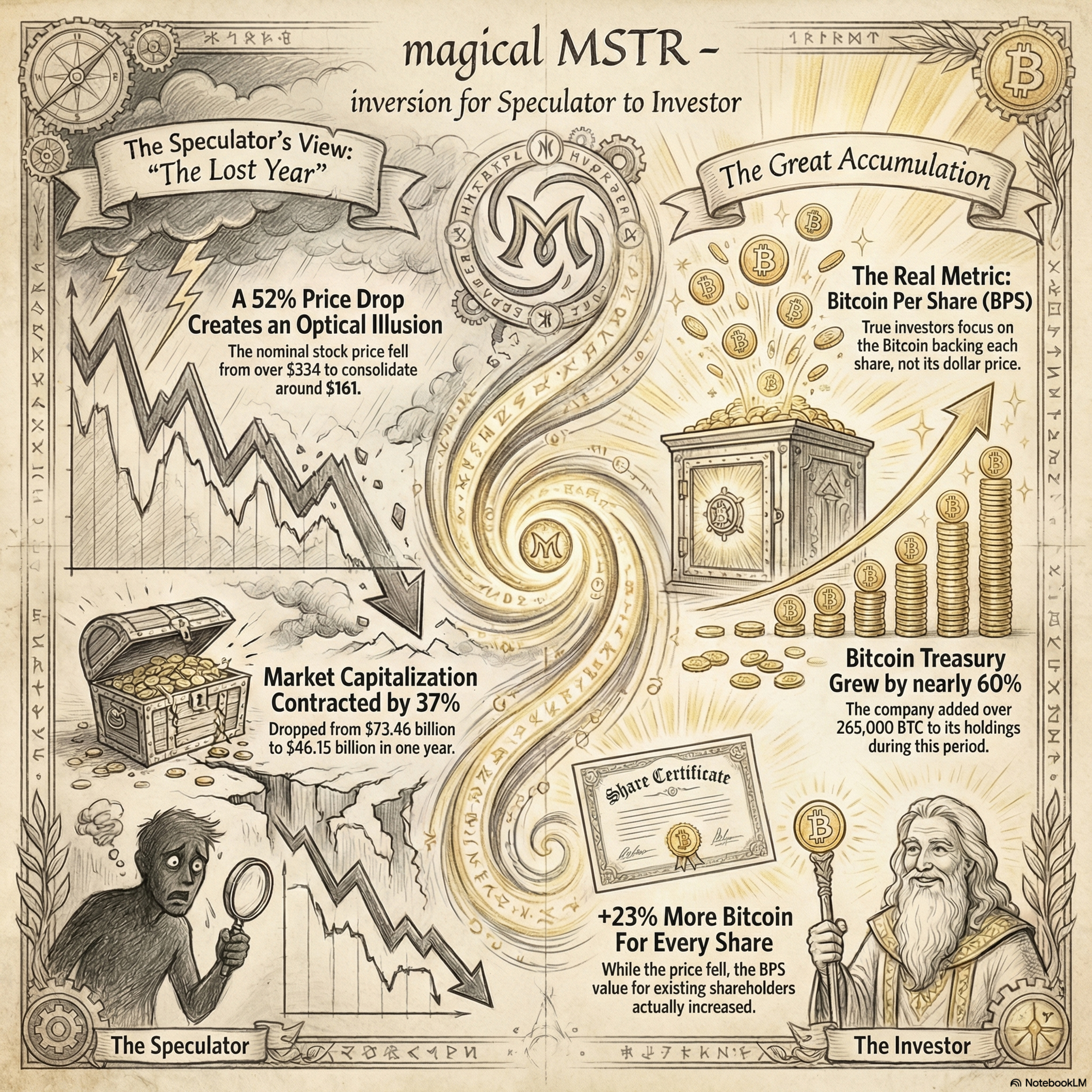

STRC course on youtubeResearch Source MosaicThis episode examines the corporate evolution of Strategy Inc. during a misunderstood "lost year" to argue that nominal stock price declines mask a period of significant structural growth. By redefining the company as a "Bitcoin Refinery," the author illustrates how the firm uses traditional capital markets to aggressively expand its Bitcoin-per-share (BPS), which increased by over 23% even as market capitalization fell. The narrative contrasts this model with traditional equities by emphasizing radical transparency and the scarcity arbitrage gained from holding a massive, non-replicable treasure chest of digital assets. Ultimately, the source posits that the company's performance should be judged by its Bitcoin Yield—a metric of asset accretion—rather than volatile fiat-denominated valuations.#StrategyInc – The text refers to the company formerly known as #MicroStrategy by this new name throughout the document.#MSTR – The ticker symbol remains the primary way investors identify the company and track its performance in the "fiat world".#MichaelSaylor – References the Executive Chairman and architect of the company’s Bitcoin accumulation strategy.#TheBitcoinRefinery – Describes the company’s operational model of processing fiat currency (raw material) into Bitcoin (output).#ScarcityArbitrage – Defines the core value proposition where the company leverages the difficulty of replicating its massive Bitcoin treasury.#InfiniteMoneyGlitch – A phrase Michael Saylor uses to describe the arbitrage of issuing shares at a premium to buy more Bitcoin, thereby increasing the Bitcoin per share for existing holders.#VelocityOfCapital – Highlights the company’s advantage over real estate or gold: the ability to deploy hundreds of millions of dollars into Bitcoin almost instantaneously.#SupplyShock – Refers to the price impact caused by massive accumulation (like ETFs or Strategy Inc.) hitting a fixed supply asset.#BitcoinYield – The primary Key Performance Indicator (KPI) used to measure the company's success in increasing the Bitcoin backing per share.#BTCperShare – The fundamental unit of value for Strategy Inc. investors, which grew by over 23% during the "lost year" despite stock price drops.#SaylorPremium – Refers to the market pricing MSTR shares higher than the Net Asset Value (NAV) of its Bitcoin holdings.#AssetAccretion – Describes the aggressive growth of the underlying asset base (Bitcoin) even while market capitalization contracts.#TheLostYear – Used ironically to describe the 2025 period where nominal stock prices fell, but fundamental asset accumulation reached record highs.#DigitalCapital – The text argues Strategy Inc. is the "world's most productive collector" of this asset class, distinguishing it from analog assets like real estate.#RadicalTransparency – A key differentiator for MSTR, allowing investors to know the exact asset backing of their shares in real-time, unlike traditional companies like Apple.#LongestHaul – Represents the investor perspective focused on terminal value and permanent capital rather than short-term trading.

See moreTop comments