Strategy vs MSCI : 6 Jan 2026 truce signals a pivot to #STRC - which is a good thing !

EpisodeJan 733m

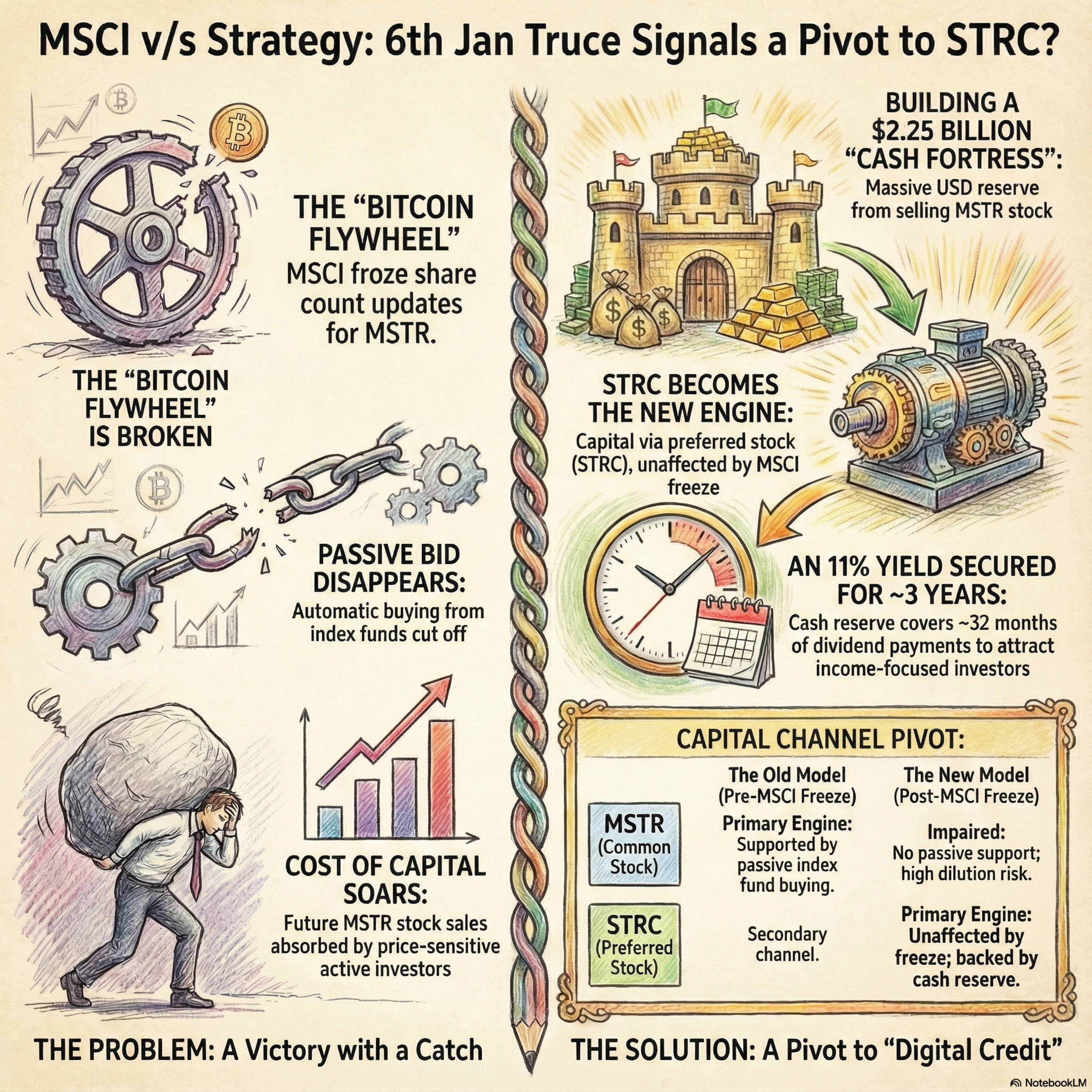

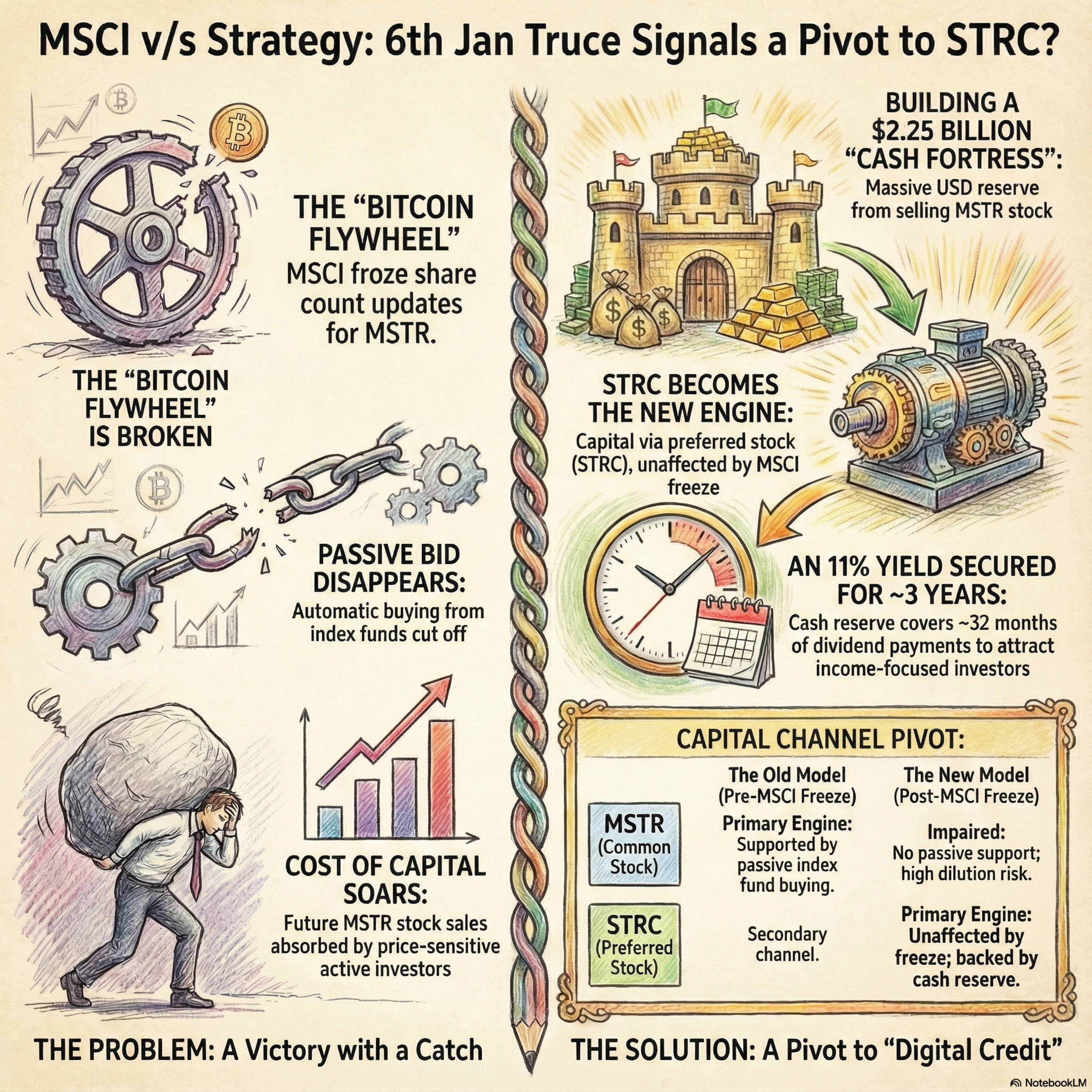

STRC Course This episode analyzes the January 2026 decision by MSCI to retain Strategy Inc. and other digital asset treasury companies within its global equity indexes, narrowly averting a massive liquidity crisis and billions in forced outflows. While the ruling represents a tactical victory for Michael Saylor’s Bitcoin treasury model, it introduces a restrictive freeze on share count updates that effectively severs the company's access to automatic passive investment demand. By disabling this "flywheel" effect, the decision significantly increases the cost of capital, forcing the firm to rely on price-sensitive active investors for future cryptocurrency acquisitions. Ultimately, the text illustrates a regulatory compromise where traditional financial gatekeepers have successfully ring-fenced digital asset firms, allowing them to remain in benchmarks while strictly containing their ability to disrupt broader market structures.#MSCI : The index provider concluded its high-stakes review and decided not to proceed with the immediate exclusion of Digital Asset Treasury Companies from its global benchmarks.#8BillionReprieve : This decision successfully averted an estimated $8.8 billion in forced outflows that would have been triggered by passive index funds.#DATCO : A new regulatory classification for "Digital Asset Treasury Companies," defined as entities holding 50% or more of their total assets in digital currencies.#FreezeTheFloat : MSCI implemented a tactical "freeze" on updates to the Number of Shares (NOS), effectively decoupling future equity issuances from automatic passive index inflows.#BitcoinFlywheel : The company’s capital markets feedback loop for acquiring Bitcoin now faces significant friction because every new share issued must find an active buyer rather than a price-insensitive index fund.#OperatingCompany: Michael Saylor successfully defended the firm as an operating business that manages structured finance and yield, rather than a passive investment fund or ETF.#ReliefRally: Following the verdict, the stock experienced a 6% to 7% surge in after-hours trading as the immediate "death spiral" risk was removed.#WalledGarden : By keeping the company in the index but freezing its weight, MSCI has created a "containment zone" that prevents the entity from introducing unlimited volatility into the benchmark.#ActiveDemand : Future At-The-Market (ATM) offerings now rely entirely on price-sensitive active managers, such as hedge funds and retail investors, who may demand a discount.#InstitutionalTruce The market views the outcome as a tactical survival victory for Saylor, though the long-term struggle for seamless institutional integration has entered a more bureaucratic phase.

Top comments