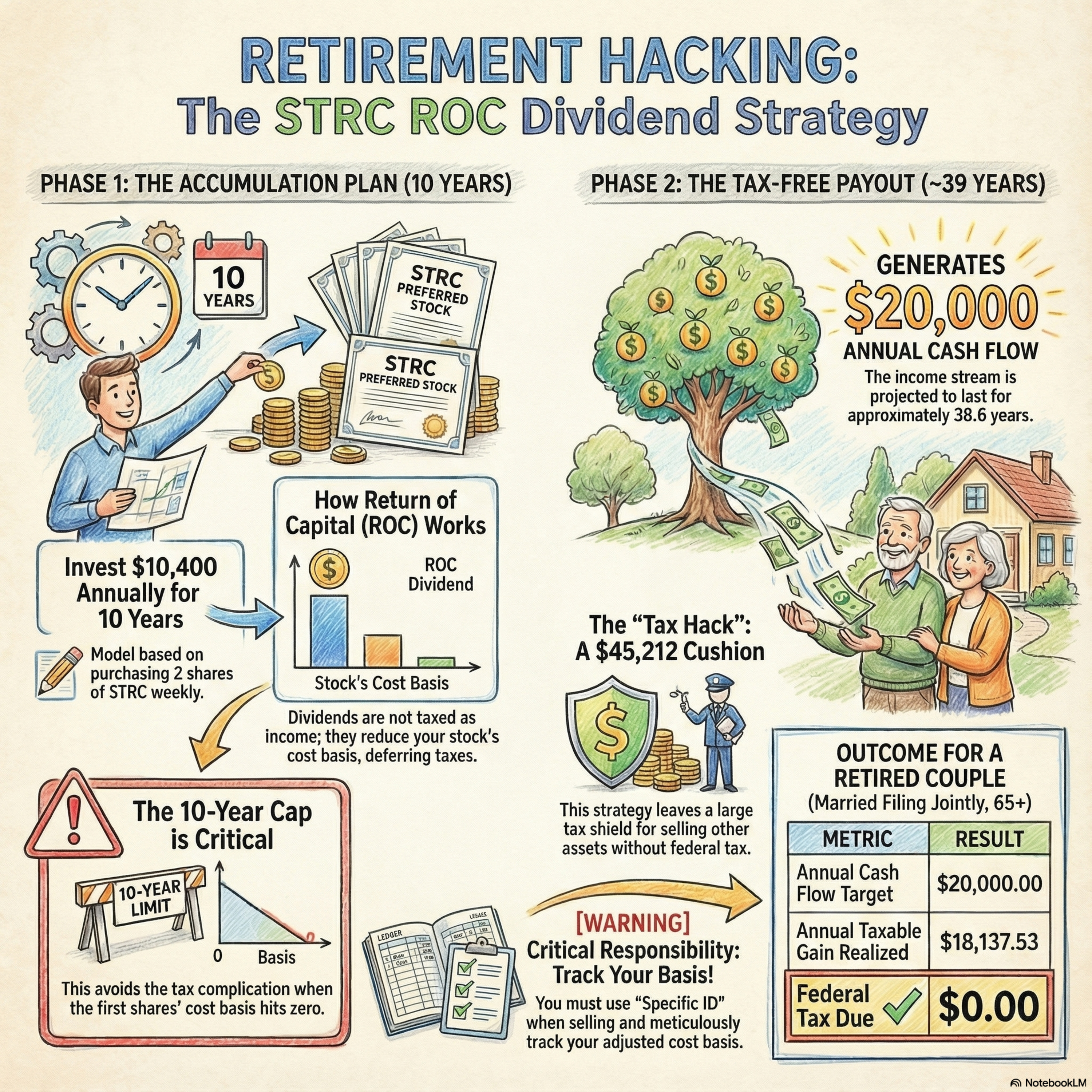

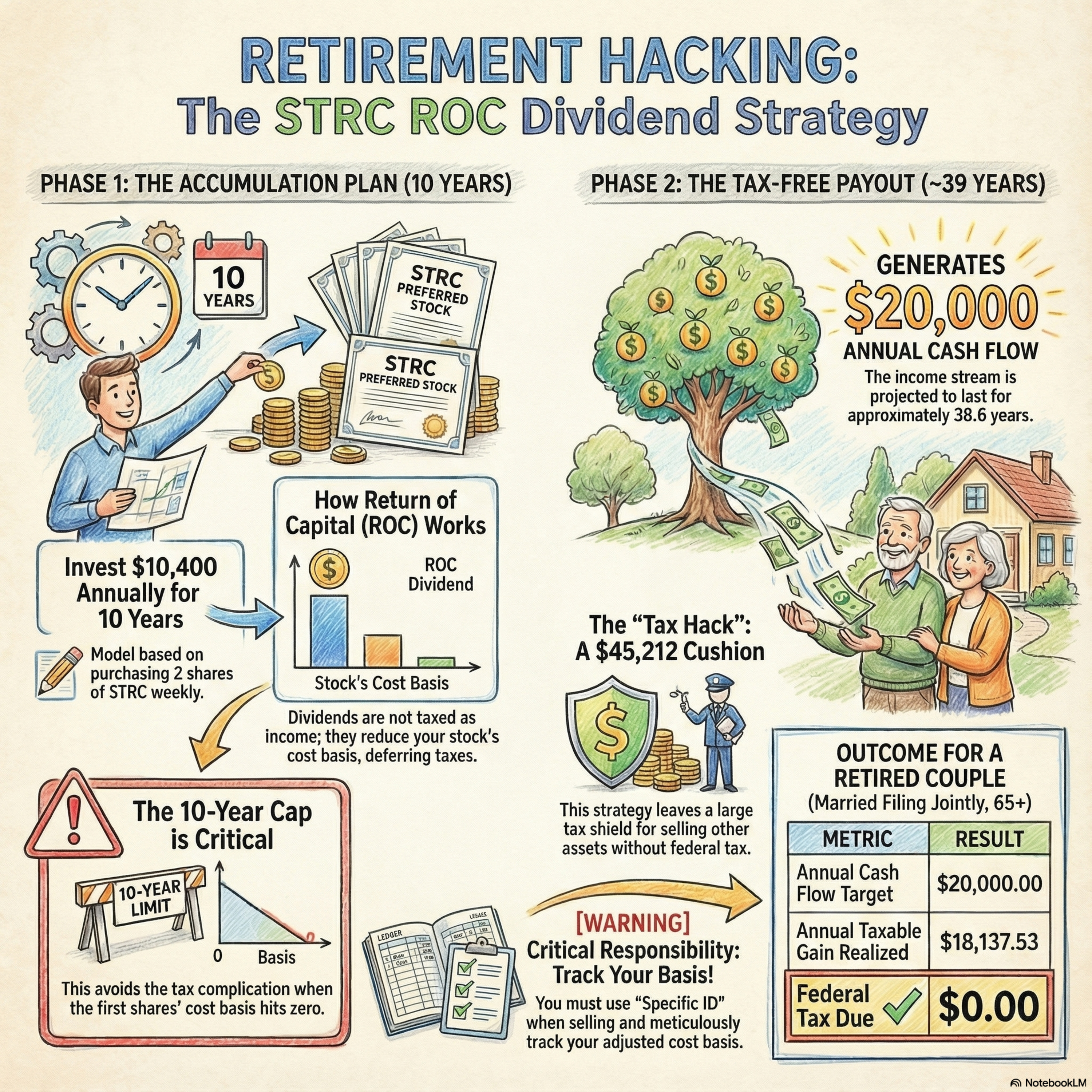

Research Model SpreadsheetMosaicCheck out the you tube comments on this episode that led to this research. Sincere thanks to community for such deep engagement. If you're between 57 and 67 and planning retirement, forget high-tax ordinary income streams. This strategy, centered on Return of Capital (ROC) dividends from perpetual preferred stocks like STRC (Strategy, Inc.), shows how to build a 40-year tax-free income stream from just 10 years of saving.Most income is taxed immediately. ROC income is different: it's legally treated as a return of your initial investment (principal). It's not taxed today; instead, it reduces your investment's cost basis. This isn't tax evasion—it's tax deferral that puts you in control.We use a simple, consistent plan over a 10-year saving window:Buy Weekly: buying 2 shares every week, totaling $10,400 per year. This consistency builds "muscle memory."Reinvest (DRIP): Automatically reinvest the ROC cash dividends back into more shares. This is crucial for compounding.The Result: After 10 years, your portfolio grows to over 1,747 shares.The goal is to establish a secure, tax-free base income of $20,000 per year that lasts for nearly 40 years (38.64 years).For a retired couple (MFJ, 65+), the government provides a large tax shield—a combination of the Standard Deduction and the 0% Long-Term Capital Gains (LTCG) tax bracket. This shield protects taxable gains up to $63,350 annually.When you retire:Sell Low-Basis Shares: You use Specific Identification (Spec ID) to instruct your broker to sell the shares that have been reduced to the lowest possible cost basis (some even hit zero).Realize the Gain: This sale realizes a taxable gain of only about $18,137—the cash is $20,000, but only the gain is taxable income.Zero Tax Bill: Since the $\mathbf{\$18,137}$ gain is far below your $\mathbf{\$63,350}$ tax shield, the effective federal tax rate is $\mathbf{0\%}$. You pay no federal income tax on your $\mathbf{\$20,000}$ base stream.The reason this only takes 10 years of saving but lasts almost 40 years is ongoing compounding. Every year you're retired, you sell $\mathbf{200}$ shares, but the remaining $\mathbf{1,547}$ shares continue to generate new ROC cash, which immediately buys about $\mathbf{155}$ new shares. You're only depleting the portfolio by $\mathbf{45}$ net shares per year, making it incredibly long-lived.This base income stream is just the start. You've preserved the majority of your tax shield.Your annual Tax Cushion Remaining is over $45,000 (calculated as $\$63,350 - \$18,137$). This means you can sell other assets (like high-growth tech stocks or real estate) that generate an additional $\mathbf{\$45,000}$ in capital gains or ordinary income, and your combined tax bill will still be zero.This strategy gives you risk-free, tax-free base liquidity to cover essentials, allowing you to be much more aggressive or opportunistic with your other assets.🚀 Retire Rich, Tax-Smart: The ROC Dividend Hacking PlanThe Strategy in a Nutshell 🌰The Retirement Payday 💸How it Works (The Tax Shield)The Power of CompoundingYour Strategic Cushion#ROCHacking #TaxFreeRetirement #RetirementPlanning #FinancialFreedom #STRC #DividendInvesting #CompoundInterest #TaxSmart #EarlyRetirement #PreferredStock #Strategy

Top comments